Public Healthcare vs. Private Insurance

Spain offers a universal public healthcare system (Sistema Nacional de Salud), funded through social security contributions. If you are employed, self-employed, or a legal resident who contributes to social security, you may qualify for public healthcare. However, waiting lists for certain treatments can be long, which is why many expats turn to private health insurance for extra peace of mind.

- Public healthcare: Free or low-cost but with waiting times for non-urgent care.

- Private healthcare: Immediate access to specialists, English-speaking staff, and a wider choice of hospitals.

Do Expats Need Health Insurance in Spain?

Yes, in most cases. If you are applying for a Spanish visa or residency permit, private health insurance is usually a requirement. For example:

- Non-Lucrative Visa: Requires proof of private health insurance with full coverage in Spain.

- Golden Visa: Also requires private health insurance.

- Digital Nomad Visa: You must show you have valid health insurance covering Spain.

Even if you are eligible for the public system, many expats keep private insurance to avoid delays and to ensure access to English-speaking doctors.

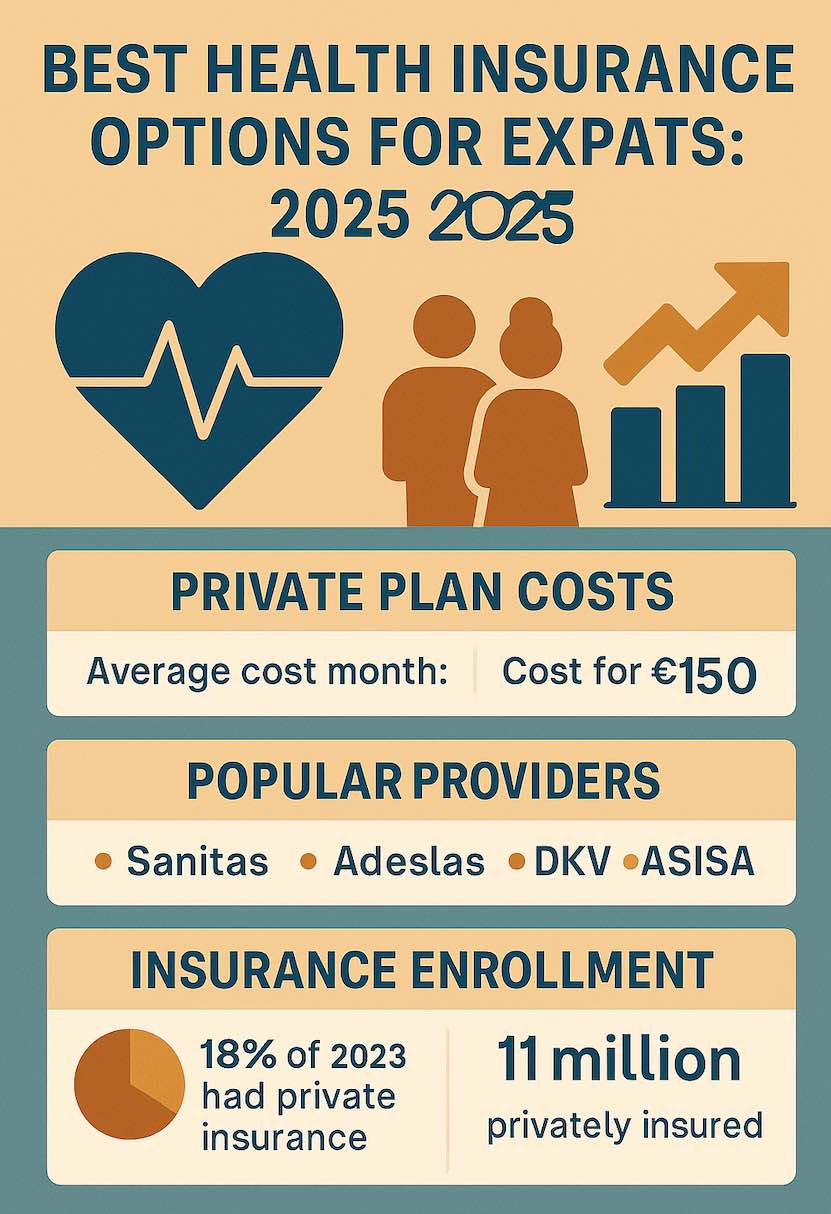

Average Cost of Health Insurance in Spain (2025)

Private health insurance in Spain is more affordable than in many other countries. On average:

- 30–40 years old: €40–€80 per month.

- 40–60 years old: €60–€150 per month.

- 60+ years old: €150–€300 per month.

Prices depend on your age, coverage level, and whether you want dental or maternity care included.

Best Private Health Insurance Companies for Expats in Spain

1. Sanitas

One of the largest providers in Spain, Sanitas offers comprehensive plans with English-speaking support, international coverage, and extensive hospital networks. Popular among expats.

2. Adeslas

Known for its affordability and wide network of hospitals. A good choice for expats who want reliable coverage at a lower cost.

3. Mapfre

One of Spain’s most recognized insurers, offering customizable plans. Well-suited for families and long-term residents.

4. Cigna Global

Popular among expats who want international coverage as well as Spanish hospitals. More expensive but ideal for digital nomads and frequent travelers.

5. DKV Seguros

Focuses on comprehensive healthcare, including preventive medicine and mental health. Offers strong customer service in English.

How to Choose the Right Health Insurance Plan

When comparing health insurance, expats should consider:

- Visa requirements: Does the plan meet residency visa obligations?

- Hospital network: Are there clinics near where you live?

- English-speaking support: Essential for non-Spanish speakers.

- Excess (copago): Some plans are cheaper but require co-payments per visit.

- International coverage: Important if you travel often.

Tips for Expats Applying for Health Insurance

- Compare at least three providers before signing a contract.

- Check if your visa requires no co-payments — most do.

- Consider long-term contracts for lower premiums.

- Make sure pre-existing conditions are covered if applicable.

Conclusion

Choosing the right health insurance in Spain is crucial for expats, whether to satisfy visa requirements or to enjoy faster access to quality healthcare. Providers such as Sanitas, Adeslas, and Mapfre are excellent options, while international companies like Cigna serve those who travel frequently.

If you want to learn more about Spain’s healthcare system, you can also read our full guide to the Spanish public healthcare system.

Pingback: Public Healthcare System in Spain: A Complete Guide for Expats (2025) - Move to Spain hub

Pingback: Public vs. Private Healthcare in Spain: What Expats Should Know (2025) - Move to Spain hub

Pingback: Spain Non‑Lucrative Visa Explained: Living Without Working - Move to Spain hub